What have restaurant finances looked like over the last year? And what’s the future?

Over the last 18 months we’ve all heard a lot of new lingo going back and forth – furlough, rent moratoriums, VAT reductions, Bounce Back loans etc. – but for most of us in this industry, we don’t have a great sense of what these really MEAN – especially if we are an employee. Or, if you’re an employer, you’ll know exactly what they mean for YOU, but perhaps not what they mean for the rest of the industry – how everyone else is coping, and how it looks like they’re going to cope moving forward.

The brilliant Viewpoint Accountants, who work with SO MANY of the restos and people you know and love – Laughing Heart, Jackson Boxer, Anna Tobias, Bright, P.Franco etc, Sager + Wild, Asma Khan AND MORE – have put together this fantastic report to provide insight to their own clients, and for us.

With their clients’ permission, they have anonymised and analysed their financial reporting data to show exactly what’s going on financially in the London independent hospitality sector in these tumultuous times. It makes for a fascinating, enlightening read.

And DON’T be put off by the charts!! It’s a really easy read, we promise, with nothing that you won’t understand. Just remember that: Q1 = Jan – Mar / Q2 = Apr – Jun / Q3 = Jul – Sep / Q4 = Oct – Dec.

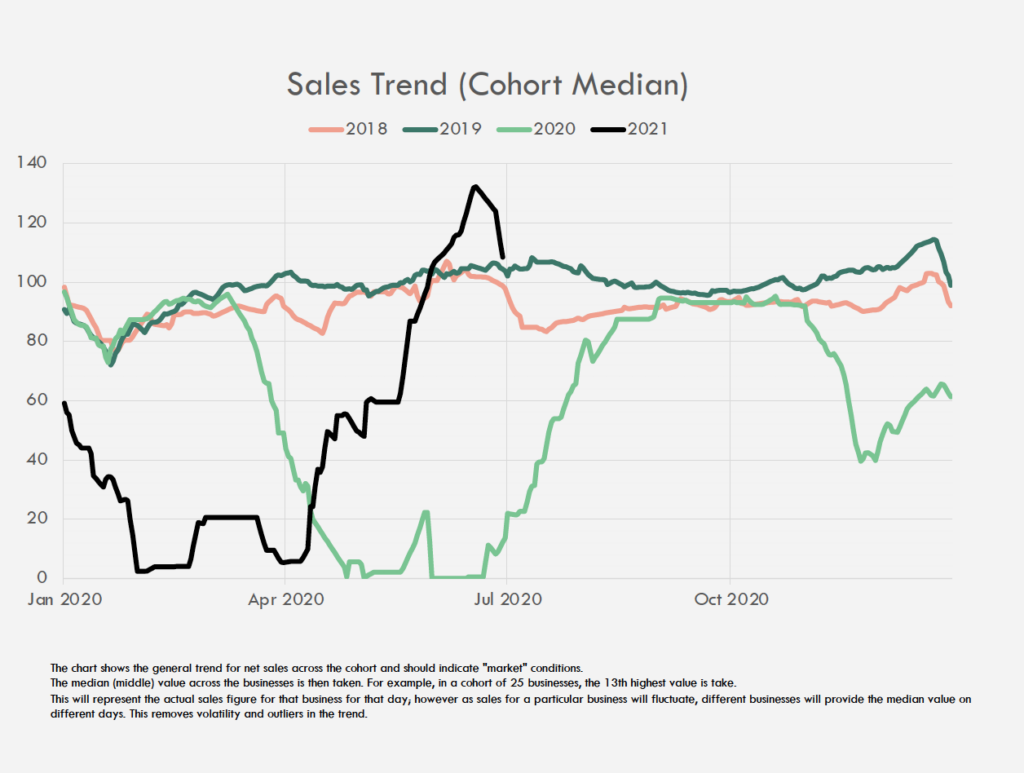

SALES TREND

- After the Government confirmed that outdoor dining could resume on 12th April, we can see another slump in sales in the weeks preceding. Many restaurants chose to stop delivery or retail activity in order to channel all energy into getting ready to open.

- Of course, not all restaurants and bars have any outdoor space to make use of.

- With outdoor hospitality open, median sales reach the same level as the beginning of the year.

- On May 17th indoor hospitality returns under restrictions. Pent up demand sees sales increase to higher than any time in the previous three years

- This sales spike reaches a peak in mind June and then drops back down. Freedom Day, which was initially slated for 21st June, is pushed back, spirits are dampened, and caution increased amongst guests. The weather also experiences fluctuations and Euro 2020 starts.

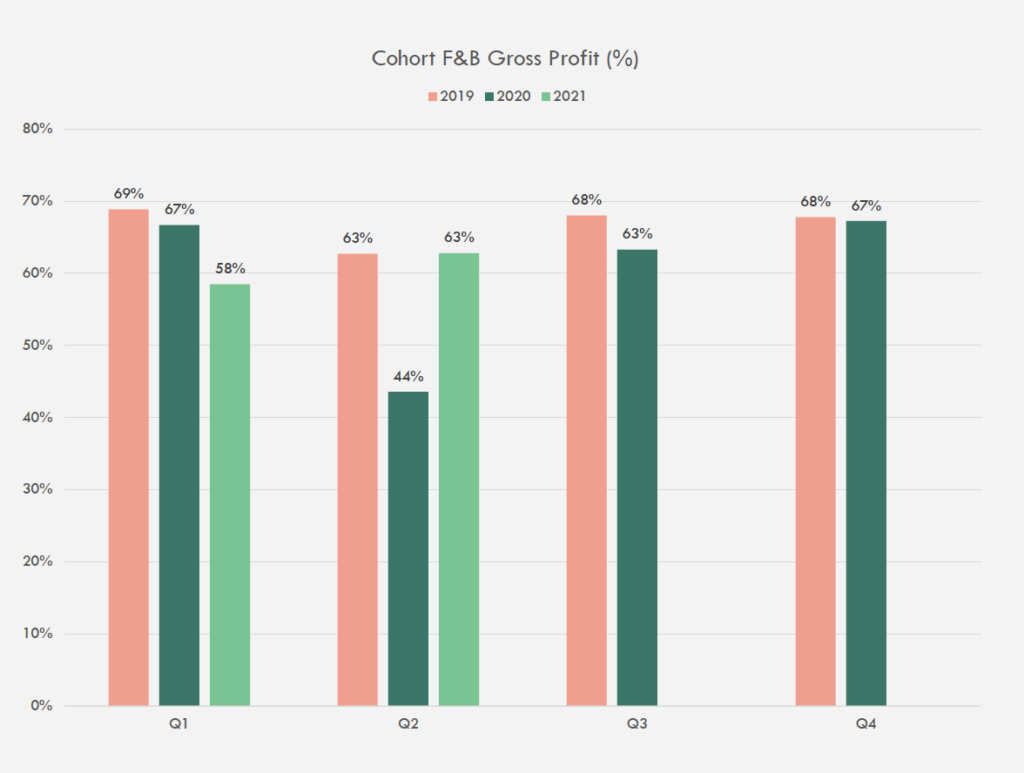

GROSS PROFIT

- Q1 demonstrates a lower gross profit on food and beverage (GP) than previous years, indicating that alternative revenue models models under lockdown are not as profitable as traditional restaurant or bar service

- Q2 tracks 2019. Because of the VAT reduction on hot food from 20% down to 5% we might expect GP to be higher, however many businesses were using hybrid models during this period, e.g. delivery until they could open for indoor hospitality. This would bring down the GP and balance the effect of the VAT reduction.

- Q2 also indicates that restaurants and bars haven’t either hiked prices or discounted prices to incentivise customers. There is no Eat Out to Help Out scheme from the Government this time, but restaurants do not appear to have filled in the gap by creating offers themselves.

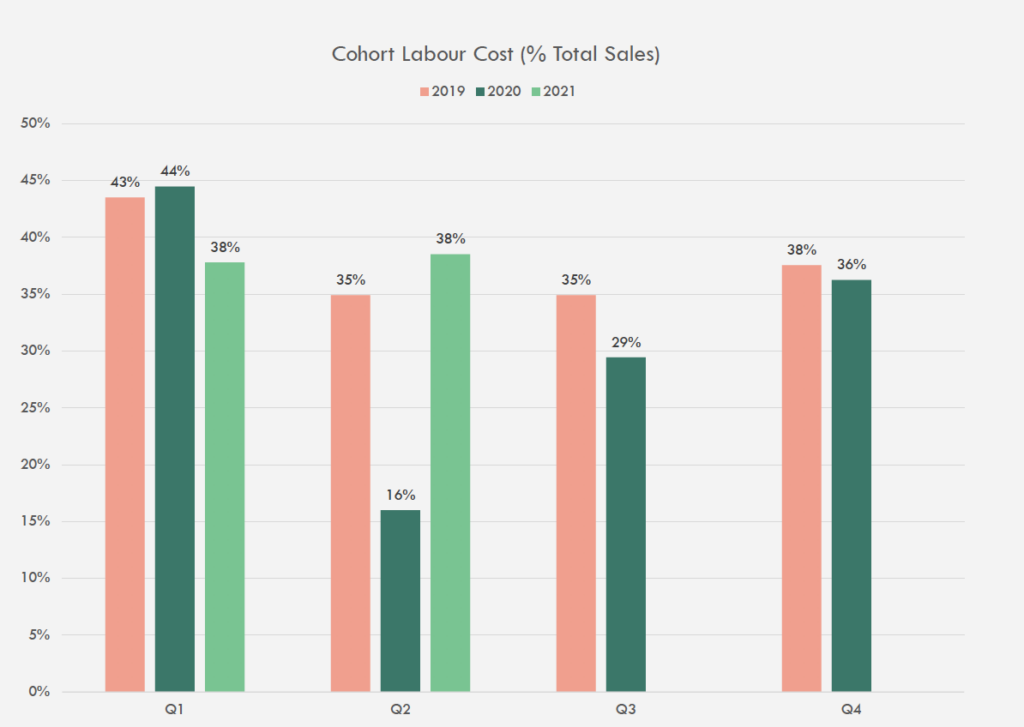

LABOUR COSTS

- Q1 2021 is slightly higher than Q4 of the previous year but lower than usual for Q1. Staff are largely on furlough unless working on delivery or shop models, with employers only contributing NI and pensions at this point

- Q2 remains the same as Q1. Over the last year of the pandemic, operators have become smart about controlling labour costs by eliminating loss-making services and utilising flexi-furlough as well as full furlough.

- Q2 is higher than Q2 2020 as employers did not need to pay NI and pensions contributions at that time and the period was spent under the first lockdown.

- Q2’s turnover is also lower than in 2019 for much of the quarter, so wage contributions form a higher percentage of turnover than paying full salaries would under normal conditions.

Insights for the Coming Months

The data so far this year shows promise in the demand for hospitality and an upward momentum in turnover from when restaurants and bars could start to reopen. This uptick has now peaked and is returning to the levels of turnover of pre-pandemic years.

For gross profit on food and beverage, we expect to see much greater GP in Q3 this year. The VAT reduction on food and soft drinks continues until September and, since 19th July’s Freedom Day, restaurants and bars have been able to trade without restrictions. There is a question mark over what happens when VAT increases to 12.5% in September (before returning to 20% in March 2022). Will restaurants take the hit on profitability, or will they increase prices to accommodate the greater level of VAT?

Labour costs have been at a median rate of 35% of turnover for our clients this year so far. Now in Q3 of 2021, the industry is operating without restrictions since 19th July, but is also facing a staffing crisis. Many restaurants and bars are unable to fully staff certain services meaning that they cannot maximise revenue. The data for Q3 will be interesting. Will there be a higher labour cost to turnover percentage, as hospitality businesses spend more on wages to attract staff and because turnover is down with services being cancelled due to staff shortage? Alternatively, will the percentage be down because fewer staff members are taking on more and more work? Would this be sustainable?

Whilst sales rose dramatically for a large part of Q2 this year, Q1 was a disaster and the background to this is that fixed costs remain and debts from last year must be paid. These include HMRC agreements, Bounce Back Loans (repayments start after one year) and CBILS. The business rates holiday finishes at the end of June and returns at 66% in July before returning to 100% in March 2022. The rent moratorium has been extended to March next year, meaning tenants cannot be evicted from premises before then, but doesn’t in itself solve the problem of accruing rent debt if a deal hasn’t been struck between landlord and tenant.

Most independent restaurants and bars do not – even in a good year – make huge profits. Successful examples can make decent profit to support business growth and comfortable lifestyles for the owners, but the business model is not one that makes an easy buck. Reading the first chart with this in mind would suggest that any turnover line from 2020 or 2021 that runs below the steady-ish pre-pandemic ones is probably at a loss-making level. Within the context of mounting debts, we can see how precarious this makes the health of a business.

On a macro level, Brexit is exacerbating the UK’s staffing crisis, as Europeans who returned home pre-pandemic find a lack of incentive to return, but Brexit is not the only issue here.

The US is also facing a staffing crisis, trying to attract employees to pursue hospitality as a valid career when in that country and our own it is often not treated or regarded as such.

This is leading to some soul searching within hospitality about how remuneration packages should be structured to attract staff, including what to do about service charge and how that in turn might affect a company’s bottom line. There are questions being asked about what a fair price looks like for a customer to pay for a meal out, whether prices should increase and how? There are also challenges being addressed about how landlord / tenant relationships should look going forward – about turnover models or rent reductions, or other less obvious, clever models.

This is a time of stress, reflection and for the most adaptable – innovation. The smartest businesses will not only survive but positively reshape the industry that they embody.