WHAT CHRISTMAS 2023 TELLS US ABOUT HOSPITALITY IN THE YEAR AHEAD

with Viewpoint Partners

In hospitality, like many industries, our actions and beliefs often stem from received wisdoms rather than actual truths. During prosperous times coasting through is feasible, but in tighter times, losing sight of the true picture is a luxury we can’t afford. Q4, the festive financial quarter which is traditionally marked by a much-needed cash injection, is a pivotal moment for hospitality businesses, setting the stage for the year ahead. However current circumstances differ, and relying on this wisdom can lead at best to disappointment, at worst to lasting damage to our strategy and goals. With the upheavals of recent years and increasingly strained purse strings, customer behaviour has become increasingly unpredictable – as 40FT owner Steve Ryan notes, “December isn’t the wind in the sails through January as it used to be.”

If Christmas can’t propel us into the new year, we can derive a different value from this period. It serves as a litmus paper to analyse behaviours and patterns, allowing us to devise strategies. While each business should undertake this analysis independently, the value increases with a broader dataset for overview. While customer predictability remains a challenge, Apricity’s Chantelle Nicholson points out that we can predict and control our own behaviour. Informed by industry-wide insight, aligned with personal observations and experiences, our actions will position us more strongly for the coming year.

Hospitality account specialists Viewpoint Partners have compiled data from 50 independent, London-based businesses to understand the crucial and increasingly tricky November/December trading, and set it against data from 2022. With pandemic Christmases behind us and the early panic of the cost of living crisis settling, this feels like the first year in a while where we can gain an understanding of what the longer term might look like. What did we learn?

CUSTOMER SPEND WAS UP – SORT OF

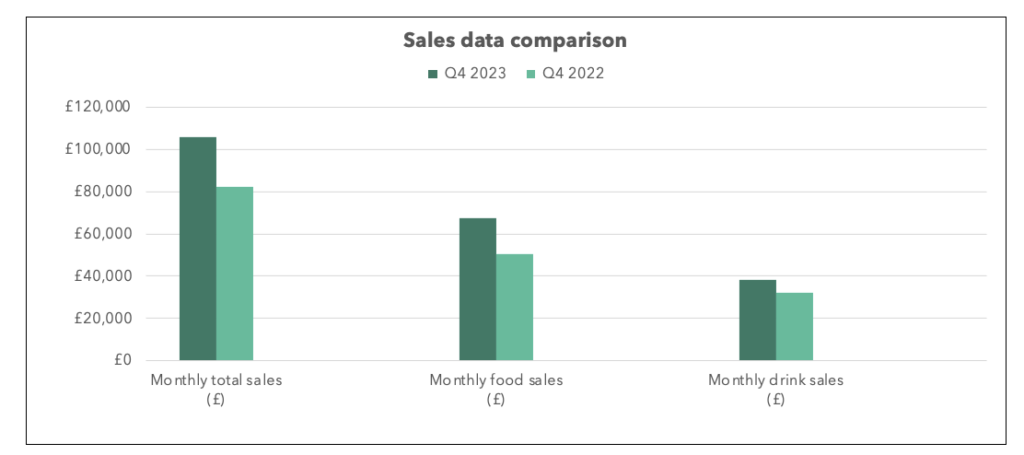

The following chart notes that total sales were up by 29% from the previous period; however the split between food sales and drink sales, alongside the covers increase of only 16%, provides a picture which may temper that optimism. This elevated figure is likely to reflect the fact that many/most businesses have increased their menu prices to offset their own rising costs of ingredients, staffing and more, rather than showing increased consumer spending power.

The figures show that spend per head only increased by 7% in spite of the elevated food prices, indicating that many customers were cutting back on other areas of their spend. So what can we do to increase these figures in our own business, in the year ahead? Jay Patel, owner of Legare, notes that customers tend to be a little less sensitive to beverage prices than to food prices in terms of value perception, and so this should be the area in which we can look to maximise spend through carefully engineered wine lists and staff training. We can see from the chart below that the food/drink split for most businesses actually decreases in food’s favour over the period leading up to Christmas, contrary to common expectation. Jay notes that seasonal alcohol sales are often based on volume, meaning that people are buying more for less. Smart menu tweaking can encourage people to continue adhering to that volume, but spend a little more while they do so.

START EARLY!

Total spend can actually go down in December, depending on where the great festive exodus happens and on your consequent closure. For many people it can be a juggling act – do you stay open between Christmas and New Year to take advantage of the few people who are still around, or do you cut your losses and close, taking a longer term view of giving your staff a good work/life balance over the period? For Katya Davies, owner of beloved neighbourhood establishments Llewelyn’s and Lulu’s, the choice is clear – but there are consequences:

“We close from just before Christmas into January as it’s always felt like the right thing to give everyone a proper break. This holiday period means that those first three weeks of December need to work their hardest! Our big takeaway this year is, as always, to be even more prepared for the next; to reach out to firmly place ourselves in customers’ minds for those smaller (independent business or friends) Christmas gatherings. Customers are more discerning than ever so it’s important to communicate clearly about what we’re delivering.’

As Katya points out, whichever you choose you’re likely to find that the last week of Q4 will generate below average to no income. So we could conclude that November should be seen as the most crucial month. The chart below shows us that spend per head doesn’t quite reach the dizzy heights of the December frenzy, which is totally natural. But starting that push early with a keen eye to menu management and great staff enthusiasm (especially before the festive ennui has set in for the team!) could make a difference at a key moment – and put good practices in place for 2024, too.

John Li from Dumpling Shack noted his own festive trading experience: “Our final quarter is always our busiest period, and we did a record October-December in 2023, there was definitely a feel good factor to this quarter. The numbers haven’t shown we have carried on with that momentum going in to 2024, we’ve had to work harder and be more creative to beat our 2023 January sales numbers (e.g taking on more events and catering, also extending opening hours). I think that is the main takeaway at the moment, things feel uncertain for 2024 but there are opportunities to make it a good year.”

PEOPLE SPEND MORE IN… JANUARY?!

Yes, the second highest spend per head – way above November – is the traditionally tragic January. But as you can see from the previous chart (and from your own experience), a high January spend per head doesn’t mean you can rely on a bumper month, as covers are way down. Hussein from Viewpoint Partners notes that this might be a month that cuts the wheat from the chaff – those with strong buying power and enthusiasm will continue to go out and keep spending, whilst those who bring the average spend per head down – people who will pay less and perhaps don’t prioritise dining out – stay in.

The traditional strategy for many establishments has been to implement January deals, tempting out the people who wouldn’t usually spend at all, which can be a smart approach. But if you do this, it is crucial to be mindful that any offers should not encourage high spenders to spend less. Consider adding supplements to set menus and ensure that there are special bits and pieces across both food and beverage to tempt spend away from your core offer, if wanted!

2022 vs 2023… vs. 2024

Katya points out: ‘We have always found Christmas a tricky period to navigate; although we felt that we cracked our menus this year – and achieved our highest average spend yet by some margin – there continue to be a host of challenges to contend with. Overheads and direct costs continue to rise, as do wages (this is particularly acute given the CoL crisis). Competition is at its toughest at Christmas as customers have so many things to attend to now we’re finally out of lockdown Decembers.” The year ahead will be a tough one, but the key is spending the next few months getting ourselves in the fittest state yet to really maximise the festive period in 2024.