UNDERSTANDING YOUR PAYSLIP IN LIGHT OF THE NEW SERVICE CHARGE LEGISLATION

With the imminent change in service charge legislation you might find that you or your team have a few more questions about their payslip than usual, especially as the figures are likely to look a little different since they’ll vary month to month, whereas previously they were stable. The essential set-up will be the same, but with some companies moving on to a Tronc system to ensure compliance, and with pay fluctuations across busy and quiet months where previously it was stabilised, there is likely to be a lot more scrutiny from staff who never usually looked that hard at their payslips – if they looked at all.

For anyone who works in the hospitality industry, understanding payslips can feel like a minefield. Even for someone on a regular salary with regular hours – perhaps working in Head Office – the tax codes and deductions are confusing and impenetrable. But what if you’re on an hourly wage, with varying shifts and then service charge on top? Things can get really complicated.

This lack of understanding and complex wage splits can create real upset and mistrust. Issues around pay and money are always extremely emotive, all the more so if the figure is lower than expected. There can be tension between management and employees, or suspicion about underpayment. This can only worsen if line managers are unable to explain to concerned or curious employees what is actually signified by the numbers, codes and terminologies that they’re seeing.

So whether you’re the person that people come to with pay slip questions every month, or whether you’re the person who’s asking the questions each time payday comes around, we’ve teamed up with Electric Mayonnaise who have put together this handy guide to help you to demystify your own pay slip, or empower you with the knowledge to explain to others.

Countertalk has created a handy A3 staff room poster for you to print out and pin up as a handy reference for your teams. Click below and please help the community by downloading, printing, and sharing the link to this invaluable free resource.

FORMAT

By law (Employment Rights Act 1996), all employers must give all their employees payslips from their very first payday, whether that’s via a paper document, an email or an online HR system. It’s good practice to receive your payslip slightly before payday – even if it’s just a day or two – to allow a little time to sort out any discrepancies.

INCOME TAX

Most people pay income tax and national insurance through PAYE, which means pay as you earn, and that figure is automatically deducted from your payslip. As an employee, you will have a PAYE reference number and pay through your employer’s payroll.. On top of this there is also an employer’s contribution: your employer will pay additional national insuranceI and tax on top of your gross salary for having you as an employee on their payroll. This could be up to 13.8% in total.

Your employer will pay all of it for you to HMRC (employee and employer combined).

PERSONAL ALLOWANCE

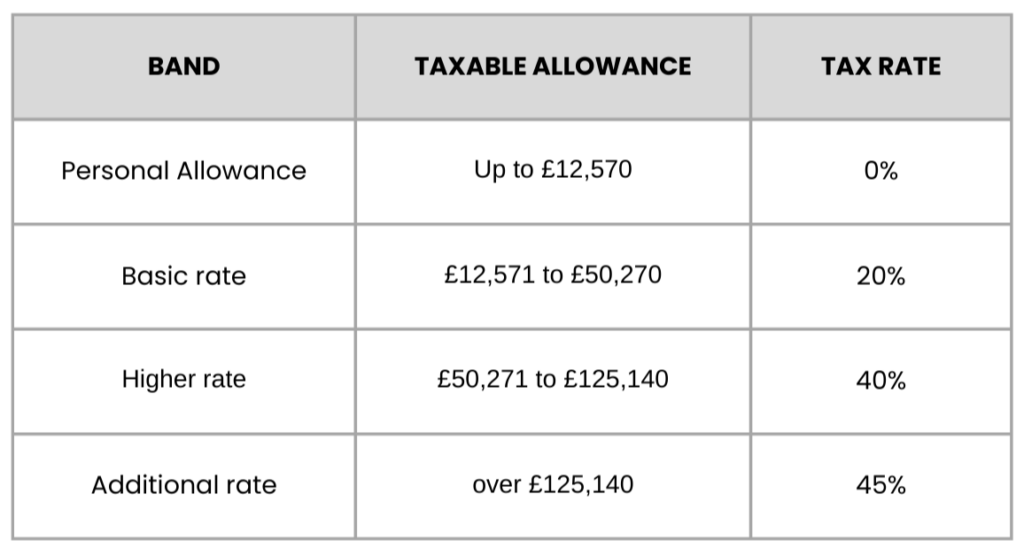

Most people receive a tax free personal allowance at the beginning of the tax year. This is generally £12,570 per year, hence the standard tax code which is 1257L. The figure could be different for a number of reasons – if you receive certain benefits or allowances then it will be more, or if you have under-paid your tax for the previous year then it will be less. Over and above that amount, employees will pay tax in bands, as follows:

NATIONAL INSURANCE

- 12% of your weekly earnings between £242 and £967 (2023/24)

- 2% of your weekly earnings above £967

- Nothing on the first £242

- 12% (£93.24) on the next £777

- 2% (£0.66) on the next £33.

As an employee, your National Insurance contributions stop when you reach State Pension age.

National Insurance is used by the government for paying social benefits like maternity, paternity, child benefits, disability allowance and the state pension. A small amount is also attributed to the NHS.

A QUICK CALCULATION:

If you are earning less than £50k p/a without Tronc, your total deduction will be between 10-20% comprising between 7-15% of tax and 3-6% of NI.

Here’s a great website for working out your take home pay: https://www.thesalarycalculator.co.uk/salary.php

TRONC / SERVICE CHARGE

At this point, it is possibly a good idea to explain that TRONC is exempt from NI contributions. This means that if you are paid a salary made up of basic house pay and TRONC, you will not pay the 12 – 14% NI contributions on the amount that is made up of TRONC. This is both a positive (because your take home pay is more) but also a negative because you will not be paying your full national insurance contribution.

It is also important to note that your pension contributions will be based on your house pay or basic and not on the combined amount, so if you are keen on saving for your pension, be sure to increase your contribution to compensate for the TRONC contribution.

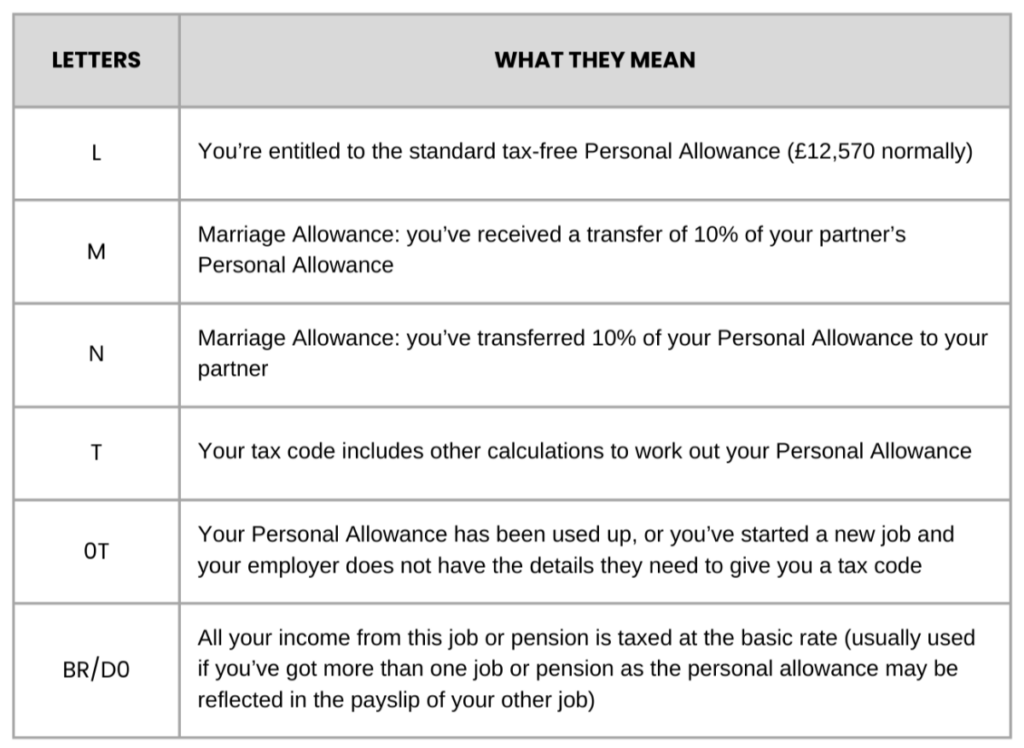

WHAT DO THE LETTERS ON MY TAX CODE MEAN?

EMERGENCY TAX CODES

If you’re on an emergency tax code your payslip will show:

- 1257L W1

- 1257L M1

- 1257L X

These mean you’ll pay tax on all your income above the basic Personal Allowance (£12,570) – which means that you’re likely to be paying more than you should. Normally, this will correct itself automatically, once HMRC receives your correct tax code, the following pay period you will see a tax credit (your tax will be lower or show a negative amount and your net pay will be higher). This is how these are generally corrected.

You may be put on an emergency tax code if HMRC does not receive your income details in time, after a change in circumstances such as:

- A new job

- Working for an employer after being self-employed

- Getting company benefits or the State Pension

Emergency tax codes are temporary. HMRC will usually update your tax code when you or your employer give them your correct details. If your change in circumstances means you have not paid the right amount of tax, you’ll stay on the emergency tax code until you’ve paid the correct tax for the year – for example, if you had paid no tax last year and you should have, it might be that HMRC will keep you on an emergency tax code (paying more tax) until you have recouped the tax from last year; at that point they would change your tax code. This is highly unusual.

You should make sure you have given your employer your P45 from your last job, or completed a starter checklist, ticking the box that most applies to your circumstances. This should reduce the likelihood or time that you remain on an emergency code.

WHAT IF MY TAX CODE STARTS WITH A DIFFERENT NUMBER?

If HMRC has calculated that you have paid more or less tax in a previous year, you might have a different number, for example, you paid £6000.00 less tax last year than you should have. Your tax code might look something like this: 6570L

£12,570.00 – £6000.00 = £6570.00

If you have paid more tax, then HMRC will usually send you a cheque or deposit the money straight into your bank account if you have an online account with HMRC. They don’t like to carry over credit into the new financial year.

SOME OTHER TERMINOLOGY / THINGS TO LOOK FOR

Gross Pay: Your salary before you have paid national insurance and tax

Net Pay or Take Home Pay: Your salary after you have paid national insurance and tax and what will end up in your bank account

Your Rate of Pay: What you are paid per hour

Your pension contribution: Currently, legislation requires a minimum of 8% of your salary contributed to your pension. This is made up of 5% from you, and 3% from your employer. You are able to opt out of your pension contributions if you choose to.

HOW TO FIND YOUR TAX CODE AND CHECK YOUR PERSONAL ALLOWANCE

- On your payslip

- On a ‘Tax Code Notice’ letter from HMRC if you get one, this is usually issued once a year towards the end of February or March

- Register for an online account with HMRC, this is generally for people who are self-employed and have to complete a self-assessment but there is nothing stopping you from creating one to check your tax code – https://www.gov.uk/check-income-tax-current-year

- Download the app (they are getting with the times) – https://www.gov.uk/guidance/download-the-hmrc-app

- Contact HMRC by phone, definitely the most difficult option as it is very difficult to speak to anyone – 0300 200 3300

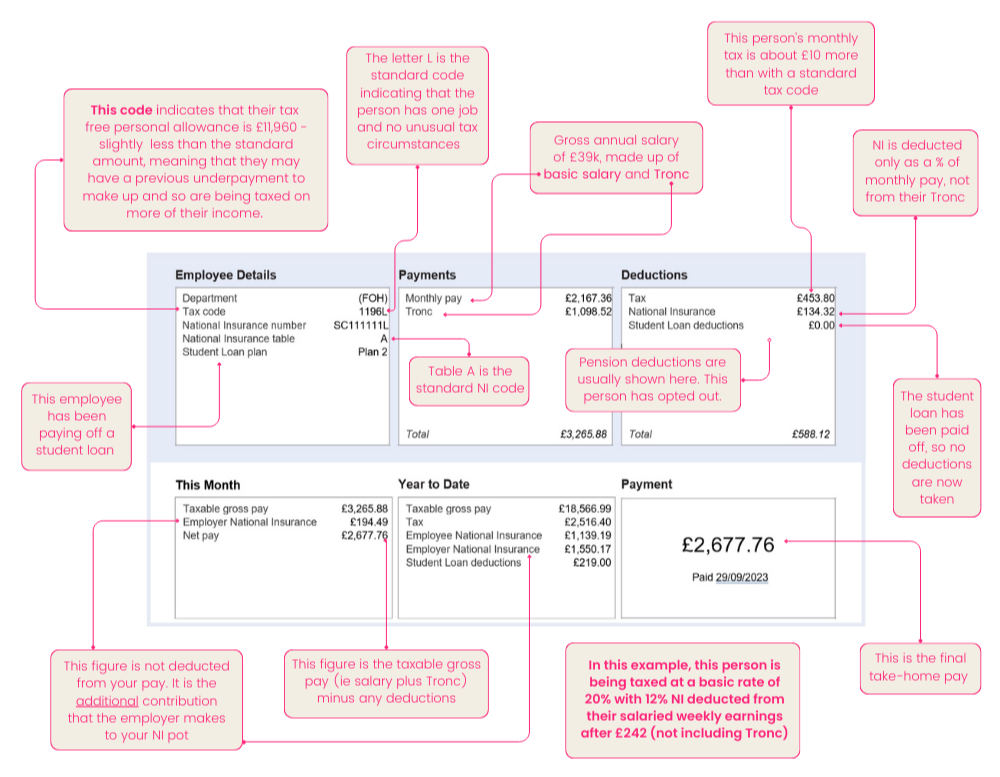

EXAMPLE PAYSLIP

We’ve put together this handy infographic to help you or your team understand each section. It’s worth noting that if they were being paid 100% out of house pay with no Tronc, and they had a normal tax code (1275L), they would be paying £440.50 in tax and £264.30 in NI. Their take home pay would be £2535.03 so, in their case, being paid in Tronc means that they are paying less NI and therefore will be net better off.

NOTE that our FREE A3 POSTER contains this infographic AND all the key information from this email, condensed into a super easy-to-read visual layout.

With additional thanks to brilliant Prue Stamp and to Tom Allerton, who both helped with input and fact-checking.

Prue is Head of People and Culture at Urban Leisure Group.

Tom is a former restaurant and bar owner and founder of Bitesize Consulting, a specialist accounting & finance provider for the food & drink and hospitality industries.